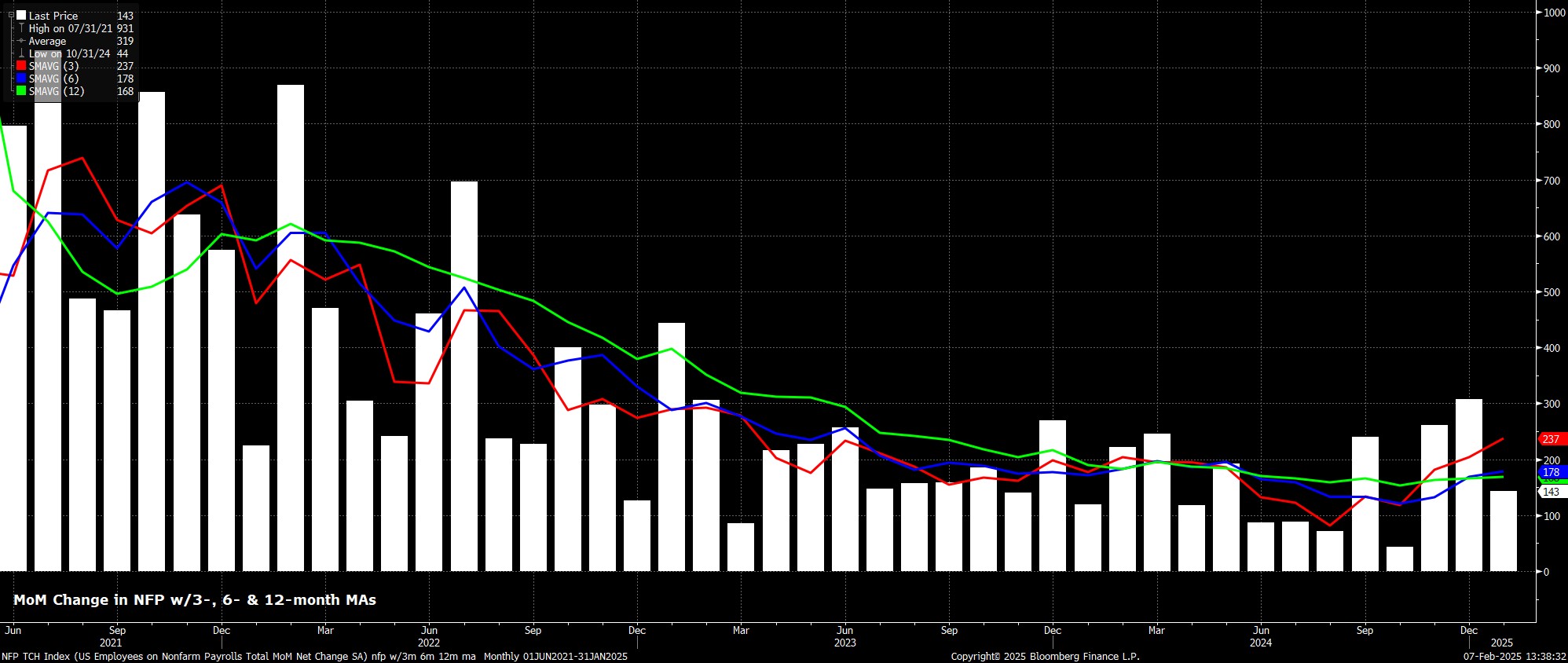

The January 2025 Payroll Report highlights a labor market that remains steady despite slowing momentum. Non-Farm Payrolls (NFP) increased by 143,000 jobs, missing expectations of 170,000. However, **strong revisions** to prior months added **+100,000 jobs**, keeping the three-month average at a healthy 237,000 jobs. Meanwhile, the unemployment rate fell to 4.0%, reinforcing signs of resilience even as hiring slows.

January 2025 Payroll Report: Sector Performance

The labor market remained **broadly stable**, though some industries saw employment contractions. Here’s how different sectors performed:

- Professional & Business Services: Declined slightly, suggesting cautious hiring in corporate sectors.

- Leisure & Hospitality: A minor contraction, likely due to seasonal adjustments after holiday hiring.

- Government Jobs: Added +32,000, supporting overall payroll growth.

- Manufacturing: Increased by +3,000, outperforming expectations of a decline.

**Wages continued rising**, with average hourly earnings up 0.5% month-over-month, higher than the expected 0.3%. On a yearly basis, earnings increased 4.1%. However, **average weekly hours declined to 34.1**, which may have artificially boosted the hourly wage figure.

How the January 2025 Payroll Report Compares to Previous Trends

Over the last 12 months, payroll growth has remained **above historical norms**, despite signs of gradual slowing. The chart below visualizes monthly payroll changes, along with **3-, 6-, and 12-month moving averages**, providing a clearer long-term picture.

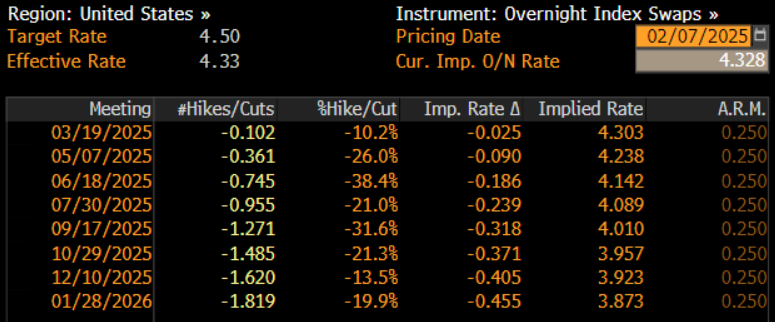

What This Means for the Federal Reserve

The Federal Reserve has emphasized that **labor market stability alone will not dictate monetary policy**. While wage growth was **slightly hotter than expected**, it is not yet signaling a need for immediate rate cuts or hikes. Current projections still point to **two 25 basis point rate cuts in 2025**, likely in the second half of the year.

Fed officials will continue to monitor inflation trends and labor market health before making their next move. While employment remains strong, **external economic factors**, such as global trade uncertainty and consumer spending patterns, could shape upcoming policy decisions.

Market Reactions to the January 2025 Payroll Report

Financial markets reacted with **caution** following the release of the January 2025 Payroll Report. The **S&P 500 saw minimal movement**, while **Treasury yields climbed** as traders assessed the likelihood of rate cuts being delayed.

The U.S. dollar **strengthened slightly**, reflecting market uncertainty about future Fed policy shifts. Meanwhile, expectations for a **March rate cut** have largely been priced out, with odds dropping to **just 10%** post-report.

Key Factors Influencing the January Payroll Data

Several external factors contributed to the mixed results in the January 2025 Payroll Report:

- Extreme Weather: Wildfires in California and winter storms disrupted employment trends.

- Post-Holiday Hiring Adjustments: Retail and hospitality sectors experienced seasonal slowdowns.

- Labor Force Expansion: The participation rate increased to **62.6%**, indicating more people are actively seeking jobs.

Looking Ahead: What to Watch for in 2025

As the economy navigates 2025, the key indicators to watch will be:

- **Upcoming CPI and inflation reports**, which will influence the Fed’s policy stance.

- **Future payroll growth trends**, to assess whether hiring remains steady or begins to contract.

- **Consumer spending behavior**, as it plays a significant role in sustaining economic momentum.

Key Takeaways from the January 2025 Payroll Report

- 143,000 jobs added, falling short of expectations but supported by strong revisions.

- Unemployment rate dropped to 4.0%.

- Wage growth rose 0.5% MoM and 4.1% YoY.

- Market reaction was mixed, with expectations for rate cuts still centered on the second half of 2025.

- External factors, such as weather disruptions and post-holiday hiring trends, influenced job numbers.

Conclusion

The January 2025 Payroll Report reaffirms a labor market that remains **resilient** despite signs of gradual slowing. While hiring fell short of expectations, **wage growth remains strong**, and unemployment continues to trend lower. Financial markets will now shift their focus to **inflation data and the March FOMC meeting** to gauge the next steps in monetary policy.